A report on the Legislative Session Week of February 8, 2016

By Senator Elder Vogel

47th Senatorial District

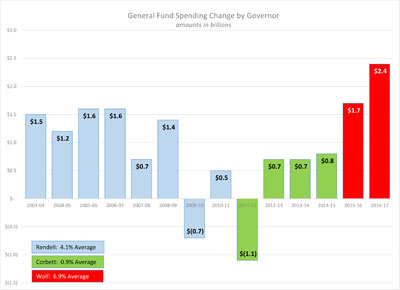

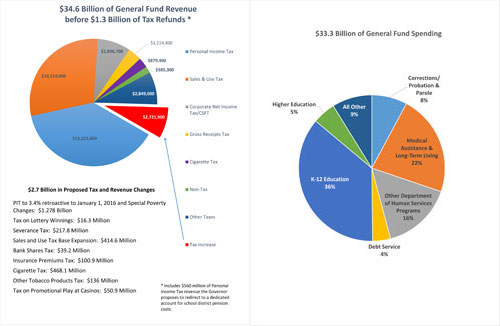

Wolf Budget Again Calls for Massive Tax Hikes, Spending Increase

It was déjà vu all over again on Tuesday as for the second straight year, Governor Wolf unveiled a state budget with massive tax increases, unsustainable spending and no reform of major cost-drivers.

Instead of making a case for his proposal, the Governor used his budget address before a joint session of the General Assembly as a bully pulpit to chide and lecture the Legislature for not passing the bloated spending plan and the excessive tax increases he proposed last year. Senate Republican leaders responded to the Governor’s comments during a news conference immediately following the budget address.

This year the Governor proposes $3.6 billion in tax hikes to support a $33.28 billion spending plan for 2016-2017. The tax hikes include a 10.7 percent increase in the state Personal Income Tax, from a rate of 3.07 percent to 3.4 percent, an expansion of the state Sales Tax to include cable bills and other items, and a new tax on fire, property and casualty insurance.

Under the Governor’s plan, the PIT increase would be retroactive to January 1, 2016, meaning taxpayers will owe an extra six months in back tax payments if the budget is enacted June 30.

The Governor’s budget increases Basic Education Funding, but abandons efforts to reform the number-one cause of school cutbacks and school property tax increases: the public pension system.

Governor Wolf again threatened draconian cuts if the General Assembly does not approve his massive tax increases. If he continues to insist that there are only two ways to address the financial problems facing our Commonwealth, it raises serious questions about his understanding of the budget process and his willingness to consider any ideas other than his own.

The Senate Appropriations Committee will hold three weeks of public hearings on the Governor’s budget proposal beginning February 22.

Charts by Senate Republican Appropriations Committee Staff

Senate Vote to Remove Attorney General Falls Short

While a majority of Senators (29-19) voted Wednesday in favor of a Resolution removing Attorney General Kathleen Kane from office due to the suspension of her license to practice law in Pennsylvania, the measure failed to meet the two-thirds majority specified by the Pennsylvania Constitution in order to directly remove an elected official from office. Senate Republicans discussed the vote at a news conference outside the Senate Chamber.

Meanwhile, the House of Representatives approved House Resolution 659, which authorizes the House Judiciary Committee to investigate the conduct of Attorney General Kathleen Kane and to determine whether she should be subject to impeachment.

Adoption of HR 659 is the first step in the impeachment process under the Pennsylvania Constitution. Depending on the subcommittee’s findings, another House resolution would be needed to formally file one or more counts of impeachment, which then would have to be approved by the House. If adopted, the Senate would conduct the trial, and requires a two-thirds vote for conviction and removal.

The Pennsylvania Supreme Court unanimously voted on September 21 to suspend Kane’s license based on accusations of perjury and other charges stemming from a leak of grand jury information. The newly elected, Democrat-majority state Supreme Court unanimously reaffirmed that decision last week.

Ag Committee Holds Hearing on Fireworks Bill

The Senate Agriculture & Rural Affairs Committee that I chair held a public hearing Wednesday on a bill that would legalize the sale of fireworks in Pennsylvania.

Senate Bill 1055 would lift the ban on the sale of “consumer” fireworks, known as “Class C” fireworks, and allow businesses legally operating in the state to sell consumer fireworks — such as bottle rockets, roman candles and mortars — to Pennsylvania residents without the need for a permit.

It’s common sense to give Pennsylvanians the same convenience as out-of-state residents and at the same time help to provide funds for our first responders. I’m looking forward to getting this prohibition off the books in Pennsylvania.

Senate Bill 1055 would generate additional revenue for the Commonwealth by requiring fireworks outlets to pay a $5,000 annual license fee. In addition to paying the state’s 6 percent sales tax, fireworks purchases would be subject to an excise tax with that money benefiting fire and emergency medical personnel.

Testifiers at the hearing included: Michael Smith from the Pennsylvania Department of Agriculture; Jerry Bostocky from the National Council on Firework Safety; Don Konkle from the Pennsylvania Fire and Emergency Institute; Danial Peart of Phantom Fireworks; Jack May of Keystone Novelties; Bob Kellner and Brian Shaub of Kellner’s Fireworks and Keystone Fireworks; and, Charles Walker of TNT Fireworks.

Written testimony from the public hearing is available at https://agriculture.pasenategop.com/.

Click for video of the hearing.

Joint Hearing Focuses on Line Item Veto and Distribution of Funds

The Senate Appropriations and Finance Committees held a joint public hearing Monday to discuss the expenditure of funds during the recent budget impasse.

The hearing focused on the State Treasurer’s role in approving warrants (requests for payment) from state executive agencies during the time period when no legal authority existed for payments to be made.

This has raised serious questions and concerns for how services critical to the safety, health and welfare of Pennsylvania’s residents will receive funding during a budget impasse or when funding is cut or reduced following a Governor’s line item veto.

Click to watch video of the hearing. For testimony and other information from the hearing, visit either the Senate Appropriations Committee page or the Senate Finance Committee page.

Options for Schools to Meet 180-Day Requirement Sent to Governor

A measure giving schools greater flexibility to meet the state’s 180-day requirements for classroom instruction after emergency and weather-related closings was sent to the Governor this week for his signature and enactment into law.

House Bill 158 would provide potential scheduling options for school entities facing extended closings that include a school year with a minimum number of hours of instruction, in lieu of the 180-day requirement, and approving additional instruction days on not more than one Saturday a month.

Also sent to the Governor was Senate Bill 166, which would allow expungement of some misdemeanors.

On Wednesday the Senate approved and sent to the Governor House Bill 561, which provides an Earned Income Tax (EIT) exemption for active duty military pay and House Bill 941, which amends the Administrative Code to:

- provide additional duties and powers related to advisory boards and commissions;

- require a report by the Pennsylvania Gaming Board to report on the potential of fantasy sports gambling;

- make changes to the Citizens Advisory Council within the Department of Environmental Protection (DEP);

- reduce the licensing fee for distilleries of historical significance; and,

- repeal the current Race Horse Industry Reform Act to provide a new article for the regulatory oversight of horse and harness racing.

Senate Sends Four Bills to the House

The Senate approved four bills this week and sent the measures to the House of Representatives for consideration.

Senate Bill 489 reduces the maximum fee that a check casher may charge for cashing government checks.

Senate Bill 568 makes changes for guardianship in Pennsylvania.

House Bill 1296 expands the financial products that municipalities, school districts, and municipal authorities may invest their general fund moneys. The bill returns to the House of Representatives for concurrence on Senate amendments.

Senate Bill 889 extends benefits to enforcement officers and investigators of the Game Commission and the Fish and Boat Commission.