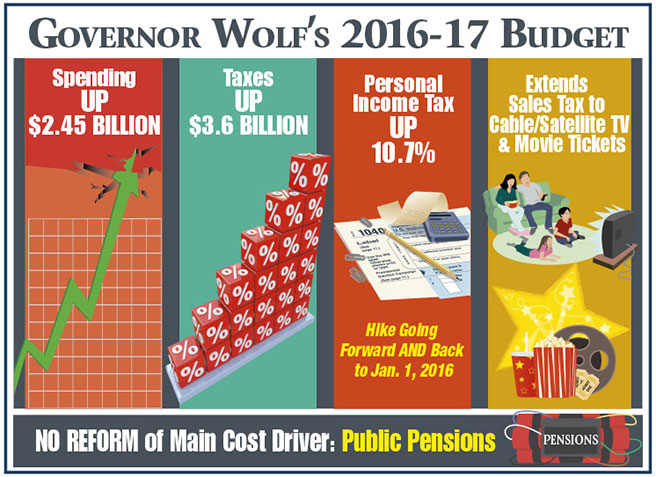

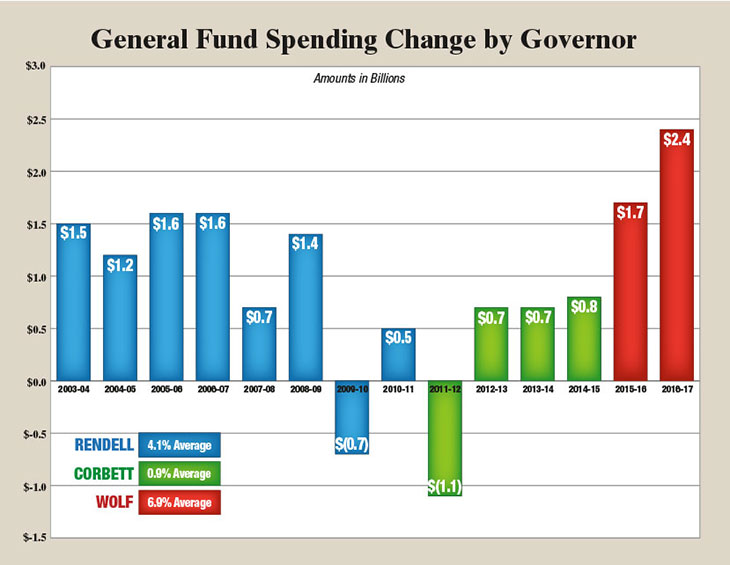

For the second straight year, Gov. Tom Wolf has proposed a state budget with massive tax increases, unsustainable spending and no reform of major cost-drivers.

Massive Tax Hikes

The Governor proposes $3.6 billion in tax hikes to support his $33.28 billion spending plan for 2016-2017. The tax hikes include a 10.7% increase in the state Personal Income Tax, from a rate of 3.07% to 3.4%, an expansion of the state sales tax to include cable bills and other items, and a new tax on fire, property and casualty insurance.

Under the Governor’s plan, the PIT increase would be retroactive to January 1, 2016, meaning taxpayers will owe an extra six months in back tax payments if the budget is enacted June 30.

No Reform

The Governor’s budget proposal includes a 3.4% increase in Basic Education Funding, but abandons efforts to reform the number-one cause of school cutbacks and school property tax increases: the public pension system.

The proposal includes restoration of the $3.3 billion in aid to schools that Governor Wolf slashed from the 2015-16 appropriation passed by the General Assembly in December, in a widely criticized bid to pressure lawmakers into approving his massive tax hikes.

More Threats to Schools

Governor Wolf again threatened draconian cuts if the General Assembly does not approve his massive tax increases. If he continues to insist that there are only two ways to address the financial problems facing our Commonwealth, it raises serious questions about his understanding of the budget process and his willingness to consider any ideas other than his own.

Response to the Governor’s Proposed Budget

Budget Snapshot

- Totals $33.288 billion

- Represents a $2.45 billion (7.9 percent) increase in spending from the FY 2015-16 budget, with the Governor’s proposed supplemental appropriations to restore several areas that he line item vetoed, such as Basic Education Funding, Corrections and Capitation. The Governor does not project a restoration of funding that he line item vetoed for the General Assembly – which gives the appearance of a major increase in funding for the legislature in the 2016-17 package.

- Without supplemental funding (which would leave schools with only six-months of state support), the Governor’s budget package would represent a $3 billion (10 percent) increase from the enacted (and line-item vetoed) budget contained in House Bill 1460.

- Is supported by a massive $3.6 billion dollar tax increase that would slam working families and small businesses. Tax increases include:

- Nearly $1.9 billion ($1,882,000,000) from increasing the personal income tax rate by 10.7 percent (from 3.07% to 3.4%).

- This tax increase would be retroactive to January 1, 2016, meaning taxpayers would be subjected to even higher withholdings from their paychecks initially to cover the preceding months of withholdings at the lower rate.

- This would take more money from individuals and impact Pennsylvania’s small businesses that file PIT returns.

- $453 million ($452.9 million) through expansion of the current 6 percent state sales and use tax to basic cable and satellite TV service, movie theater tickets, digital downloads and by capping the fee businesses can take for collecting the tax at $300.

- $584 million from a $1 per-pack increase in the cigarette tax.

- $146 million from taxes on cigars, smokeless tobacco and e-cigarettes.

- $218 million ($217.8 million) from a Shale Severance Tax based on 6.5% of the value of the natural gas, with a credit for the amount paid in Act 13 impact fees.